TL;DR: Personal finance is low-key super important. My YouTube playlist for learning. 7 key points below before actually investing. My multi-currency budgeting spreadsheet. Telegram for my portfolio updates.

It’s March 2020 and the stock market is taking a nosedive (pictured above on the right) due to the Covid-19 pandemic. My digital bank Revolut adds the ability to buy stocks. That’s when I got into stocks and the investing mindset. But the best of all of this has been understanding personal finance and taking it more seriously.

Personal finance and managing your money is a really important part of life that, at least from my experience, isn’t really taught in schools and is rarely discussed in close circles. So if this info isn’t passed down from your parents, you fall behind on financial literacy. Furthermore, financial wellness is more determined by how you manage your money than simply your income.

Saving & investing are pillars of good personal finance. Investing is making money work for you in the medium to long term while you’re busy with life. It is not a get-rich-quick scheme. When we don’t talk widely about good investing, it leaves a void for scammers to lure the average person with false investments. If someone offers you “guaranteed” profits without presenting any risks nor financial protection, you should be extremely careful before deciding to enter.

In this series, I share my investing journey, starting with 7 key points before actually investing. The first 2 key points I think everyone should be considering even if not planning to invest.

I am no financial advisor and nothing in this blog should be considered financial, tax or investment advice. Everything here is knowledge sharing and my opinion. Always do your own due diligence.

- Learning

- 1st: Eliminating bad debt

- 2nd: Emergency fund

- 3rd: Financial goals

- 4th: Active or passive?

- 5th: Taxable or non-taxable account?

- 6th: Asset classes

- 7th: How much per month?

- Closing thoughts

Learning

“An investment in knowledge pays the best interest.”

— Benjamin Franklin

Most of my learning on investing and personal finance has been from YouTube and supplemented by my own internet searches. I’ve made a YouTube playlist with all the videos that I’ve found helpful, sorted from basics to more advanced topics. If you’re new to investing I highly recommend watching at least the first 3 videos. Pro tip: I normally watch at 1.5x speed.

I’ve also made this succinct summary of the playlist that you can use to jump to topics that may interest you. I follow the channels/accounts below and you may see them a lot in my playlist because their content is gold. What you should keep in mind is they’re all in the US so some things like tax may be different for you where you live.

- Minority Mindset: education

- Investing With Rose: education

- Instagram: The Millennial Money Mentor: education

- Joseph Carlson: shares his portfolio and news analysis

Short recap

Asset: Puts money in your pocket, usually through future profit and/or income. Common examples include stocks, bonds, real estate and commodities like gold.

Liability: Takes money from your pocket; basically anything that’s not an asset. Some noteworthy examples include debt and a car losing value (especially a brand new Lamborghini). A car taking you to work to earn an income is NOT an asset.

Trading vs investing: Generally, trading is short-term buying and selling for profit while investing means holding assets over a longer time (think years). Trading takes a lot of time and skill, similar to a job, and you’re up against (institutional) traders with a lot of money, skill, experience and algorithms.

Inflation: Things costing more money over time due to the decline of a currency’s purchasing power. For example, $100 today can buy fewer things than $100 10 years ago.

Stock: An asset representing ownership of a fraction of a company. Units of stock are shares. As a shareholder, you can even vote on some company decisions (depending on your broker)!

Dividend: Some companies use part of their profits to reward their shareholders every few months or every year.

Index fund: This allows investing in a single, pooled basket of different assets that track an index, e.g. the top 500 US companies (S&P 500) or a specific industry like real estate, instead of having to buy individual company stocks.

Mutual fund: Like an index fund but the basket of assets is actively managed (selected) by a team of people instead of the selection being made objectively by an index. These funds tend to have higher fees than index funds and most don’t outperform index funds in the long run.

ETF (Exchange-Traded Fund): A single basket of assets that can be bought and sold just like a stock and its price moves up and down many times in a trading day. An ETF could be for an index or a mutual fund.

Bond: Owning a bond means being the lender to a borrower, typically governments or companies wanting to finance projects or operations. Usually, the borrower pays interest (annually or more frequent) to the lender/bond owner.

Commodity: A natural/scarce resource like gold or oil, an agricultural product like wheat, or even livestock animals.

Cryptocurrency: a digital currency secured by cryptography and typically without a central authority like a bank. Most including Bitcoin are on decentralised networks based on blockchain technology—a distributed ledger enforced by a disparate network of computers.

Mindset

“I will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful.”

— Warren Buffett (one of the greatest investors of all time)

Markets are emotional: Asset prices are fundamentally driven by human emotion and the dynamics of supply and demand. Many people buy assets with greed/FOMO (Fear Of Missing Out) when prices are shooting up, and panic sell with fear when prices are going down. Places like the stock market are the only places where people run away when prices come down (a good investor sees a sale), and people want to buy more when prices go up.

News: It’s a good idea to avoid daily financial news and trends while investing as a lot of it can be considered noise to a long-term investor. The media is in the business of publishing news that sells, i.e. news that stirs emotions. Some even suggest going against the news, for example, if the news says that the markets are crashing and hope is lost, then that is a great time to be buying, think a Black Friday sale.

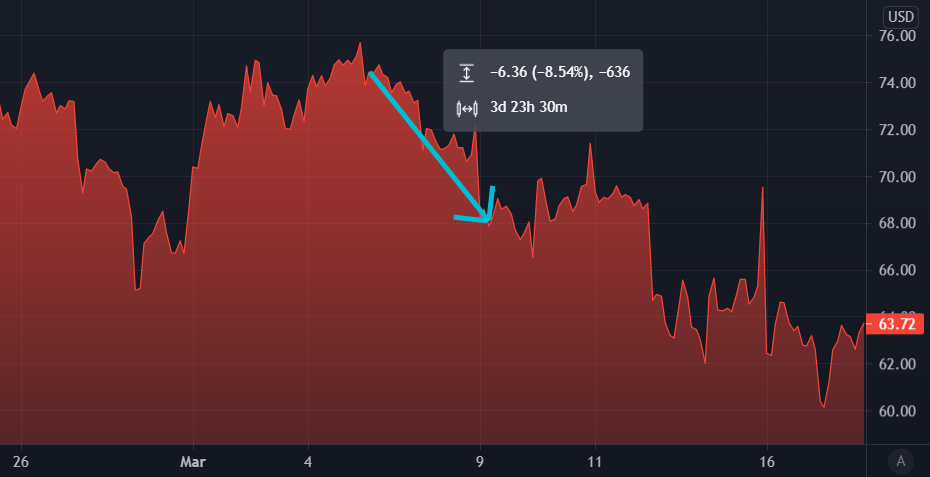

Crash = sale (not sell): A major key to remember is that investing (medium- to long-term) means going through multiple market cycles and their ups and downs. Never panic sell, which I did at the very beginning when I was clueless during the 2020 stock market crash. For example, I bought (fractional) shares of Apple and panic sold them 4 days later at a loss of 9%:

If I continued to hold those same shares through the crash, 14 months later they would now be worth 70% more than my cost to buy them.

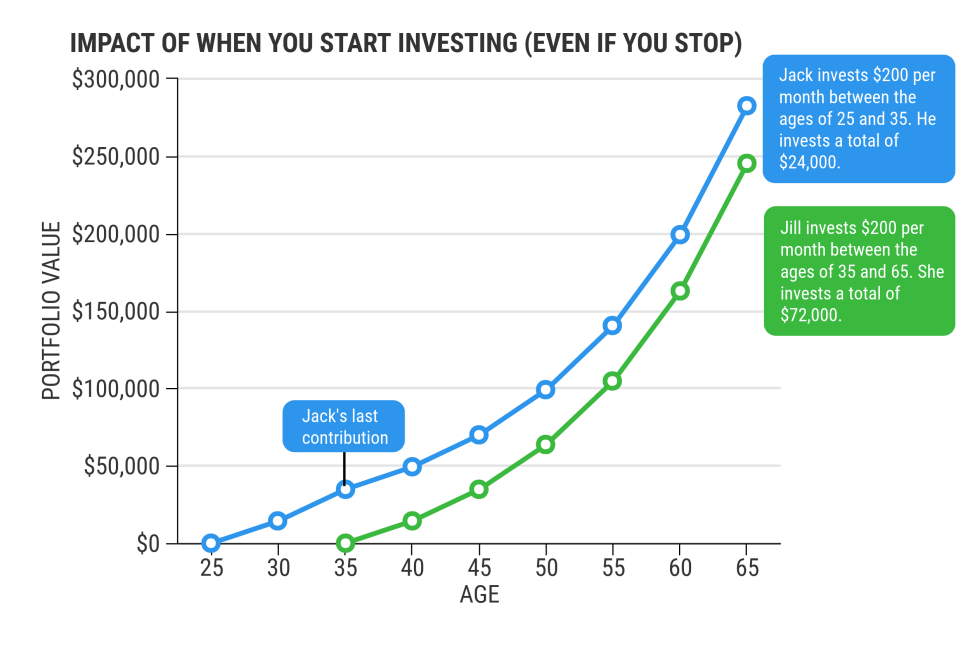

Time is the greatest asset: Jack & Jill both invest $200 per month but Jack for 10 years (ages 25-35) while Jill for 30 years (ages 35-65). While Jill has put in 3 times as much money as Jack, at age 65 Jack has a larger portfolio value than Jill because he started 10 years earlier. Starting investing earlier has a greater impact than contributions in later years.

© Coryanne Hicks & Nate Hellman

© Coryanne Hicks & Nate Hellman

“Compound interest is the 8th wonder of the world,” reportedly said Albert Einstein. Time allows investments to compound, much like continually rolling a small snowball on snow to grow it into a snowman’s body. The bigger the snowball gets, the more snow it gathers when rolling. Withdrawing profits or dividends early reduces compounding effects. The truth is that too many people are impatient and look for get-rich-quick schemes.

Investing always has risk and nothing is guaranteed. You could even get back less than what you invested. In general, as many decades of history has shown, a well-diversified investment portfolio doesn’t lose money in the long run.

The past doesn’t guarantee the future: For example, just because Tesla stock went up over 700% last year, it doesn’t mean that it will continue to do that every year. You would have to understand why the stock did so well last year and realistically what the future holds for the company. Prioritise fundamentals and analysing the future over recent past performance.

Money is just fuel: It amplifies who you are and your character.

1st: Eliminating bad debt

Stop the bleeding.

Debt is an inevitable part of life, be it for education or a home, but some are far worse than others to have. They can also affect your credit score in different ways. One key determinant of how bad a loan is is the interest rate. There isn’t a definitive, fixed threshold percentage but it can be compared to:

-

local inflation: just to give an idea, as of writing this, the UK (a developed country) has a rate of ~1.6% while Tanzania (a developing country) has ~3.7%.

-

investing returns: US stocks benchmark S&P 500 has a long-term average of 7-10% (USD). The idea here is if a loan’s interest rate is lower than this, then it usually makes more financial sense to invest instead of trying to pay the loan sooner than planned.

The usual bad debt suspects are credit card debt and payday loans. The former is a pretty big problem in the US and the latter is the worst kind of debt mentioned here. Typical credit card interests are above 20% especially when you consider compounding interest (APY) instead of the advertised APR without compounding. See APR vs APY for more info.

I don’t use a credit card but the right way to use one would be to fully repay the debt at the end of the month instead of paying the minimum payment needed and carrying the debt (plus interest) over to the next month. If I had high-interest debt like credit card debt or a payday loan, I would live like I’m broke and put as much of my money as possible to ending all bad debt. I would not start investing before this is done.

UK student loan: I did my undergraduate studies in London and financed them with a loan from the UK government. The interest rate is variable; I have seen mine go as high as 5% but now it’s at 2.6%. UK student loan is unique (I’ve had trouble explaining it to French banks) in that it will be written off 30 years after my first repayment, even if there is a remaining balance. This is great especially seeing that my repayments are less than the added interest so the balance keeps increasing!

2nd: Emergency fund

The cushion when you fall.

At the same time as making a plan to eliminate bad debt (if any), a plan should also be made for building the emergency fund. It’s savings in a bank account for emergencies, not holidays nor investing. Why we need it:

- Liquidity: money quickly ready for an emergency expenditure; cash is more liquid than investments.

- To avoid needing to sell investments at a loss during market declines or crashes to cover an emergency.

- To let investments compound over time without disruption.

An emergency should be:

- Necessary: you can live without Apple’s newly released iPhone.

- Unexpected: expected means you should’ve budgeted for it earlier.

- Urgent: can it be delayed?

The general rule for the amount of this fund is to be able to last you 3-6 months when you have no income. Less than 3 months is not enough cushion and significantly more than 6 months exposes you significantly to inflation losses.

The vast majority of saving bank accounts don’t consistently offer interest rates higher than inflation so saving is losing. This goes against the belief that most of us are led to believe from a young age: “save everything in a bank account”. There’s a limit to how much to keep in a cash bank account long-term.

3rd: Financial goals

“It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for.”

— Robert Kiyosaki (author of Rich Dad Poor Dad)

After figuring out how much I need for my emergency fund and setting a plan to build it, the next step was to ask myself what my financial goals are. The common themes when asking yourself this question include wealth accumulation/growth, wealth preservation, passive income and time horizon. Risk tolerance is also another question to ask yourself.

I don’t think one can aim for substantial growth and have low risk tolerance. Growth implies seeking higher volatility which means investments can go up strongly as well as down strongly (at least in the short-term). Time horizon and risk tolerance are usually linked; a shorter time horizon means less risk can be taken.

This link is largely due to market cycles. For cryptocurrencies, it currently appears to be almost 4 years (due to Bitcoin halving). For the stock market, it’s a lot less definitive and with many factors but let’s say 10-20 years with a lot of uncertainty. Investing for shorter periods than these while the market is going up has the risk that one day the market will enter the decline phase of the cycle.

For me right now in my mid-20s, my goal is growth. I will use my investments as a means to a financial freedom/early retirement, while along the way using portions of it for big projects like buying real estate. I can tolerate relatively a lot of risk. As I progress through the decades (and have a family), my goal will transition to less growth and instead more passive income and less risk.

Now I need to commit to always align my investments to my financial goals.

4th: Active or passive?

“Don’t look for the needle in the haystack. Just buy the haystack!”

— John Bogle (inventor of index fund investing)

With financial goals set, the next step determines time and effort commitment and the range of possible return on investment:

-

Passive investing is performing as well as the market by investing in index funds or index ETFs.

-

Active investing is trying to beat the market. This requires doing more research to choose individual assets like company stocks instead of investing in funds. It would also need me to stay informed and check on my companies/assets from time to time, let’s say at least a few times per year. There is also higher risk, for example, a company going bankrupt and my shares becoming worthless.

I could also have chosen to go for a mix of both, for example, majority passive with a few company stocks I believe in. Active investing requires one to be confident in their mathematical and analytical skills, or at least work to improve them. It is also a greater test of emotion and discipline.

Most (82% of) mutual funds actively managed by a team of professionals don’t beat the market, i.e. index funds. The same holds for active, retail investors trying to do the same thing. The problem as explained in this Forbes article is not sticking to the plan when underperforming. Of the 18% of fund managers that beat the market in a 15-year period, 97% underperformed the market for at least 5 of those years. I think for many active, retail investors there’s also the emotional pitfall of buying high and selling low instead of holding long-term.

Having said that, the pandemic and its lockdowns gave me a lot of time to learn and practice active investing. I am confident in my general analytical skills. Having a long time horizon and a relatively high risk appetite gives me room for error and time to correct my strategy.

5th: Taxable or non-taxable account?

“I’m spending a year dead for tax reasons.”

— Douglas Adams

It is said that our biggest monetary expense in life is tax! Its many forms include income tax and Value-Added Tax (VAT). Unless one lives in a perfect tax haven, making some profit or income from investments normally leads to paying taxes for it. So arguably the biggest determiner to one’s take-home return on investment is how much one pays in tax on their returns. Also, normally profits and all dividend are taxed even if not withdrawn so this can hinder reinvesting dividend (for the compounding effect).

Many countries provide investment accounts with lower or no tax under conditions such as lock-in period, maximum yearly input or limited asset choices. If you aim to live off your investments in retirement, it’s sensible to seek a financial advisor to find out the most tax-efficient way to withdraw, especially as tax rules can change several times over the years. I will give a summary of what I understand but always do your own research and/or seek a tax advisor in your jurisdiction.

In the UK, a Stocks & Shares Individual Savings Account (ISA) can be used by UK taxpayers to not get taxed on any profit or dividend made within the ISA. The maximum one can put into it is currently £20,000 for the tax year 2021-22. In a non-ISA, profits are subject to capital gains tax if above the tax-free allowance, currently £12,300 for the tax year 2021-22. For dividend received in a non-ISA, there’s also an allowance, currently £2,000 for the tax year 2021-22.

In France, there is the Plan d’Épargne en Actions (PEA) that typically has a 5-year lock-in period, has lower or no tax but still subject to social security contribution (17.2%) on gains at withdrawal. If withdrawing early, tax is exempt under certain conditions such as starting a business or retirement; otherwise, gains are taxed at 12.8%. One big drawback with these accounts in France is they limit to investing in companies registered in the European Economic Area (EEA) and funds that provide less than 25% exposure outside this area; so no individual, international stocks. Also, there are fees everywhere such as 0.5% transaction fee if online, otherwise 1.2%.

So currently only being a French taxpayer aiming for active growth, and seeing that there is still 17.2% social security contribution to pay when withdrawing from a French non-taxable account, I have not chosen the PEA and instead willing to be taxed for the sake of more international investment choices.

6th: Asset classes

“The individual investor should act consistently as an investor and not as a speculator.”

— Ben Graham (the father of value investing)

After tax, the next biggest determiner to returns is asset class allocation, even more than the choice of which individual assets.

Basics

An asset class groups investments that show similar characteristics. For example, stocks and bonds behave quite differently. Each asset class has its own profile of risk, volatility and possible range of returns. Diversifying is very important because it can reduce the risk and volatility of the investment portfolio as a whole while delivering more stable returns.

Correlation is also important to consider. Correlation is a statistical measure of how two things move compared to each other (but not saying which causes which to move). Having asset classes with low (or negative) correlation to each other can mean that when one goes down, the others tend to be unaffected (or even move up if negatively correlated).

I think the 4 major, noteworthy asset classes are:

-

Stocks a.k.a. equities: volatile in the short term, follow the economy in the long run. Wide range of stocks for different financial goals.

-

Bonds a.k.a. fixed income: least volatile, lowest (but not zero) risk. Price is affected by inflation and central bank interest rates.

-

Commodities: run parallel to inflation in the long run. Relatively low correlation to other asset classes.

-

Cryptocurrencies a.k.a. crypto: young, rapidly evolving, highest volatility, highest risk, highly speculative right now. Correlation to other asset classes is evolving & inconclusive.

Other major asset classes include cash, foreign currencies and valuable inventory like artwork and collectables. There is also one more which for this scope I’m classifying as part of stocks:

- Real estate: price and rental income run parallel to inflation in the long run.

Geographies is another aspect to diversify instead of putting all your eggs in one country or region of the world. A common way to classify:

- Domestic (your country)

- International developed countries

- Emerging countries

Allocations

With some understanding of the characteristics of the different asset classes, the next step is to assign a percentage to each of them based on one’s financial goals.

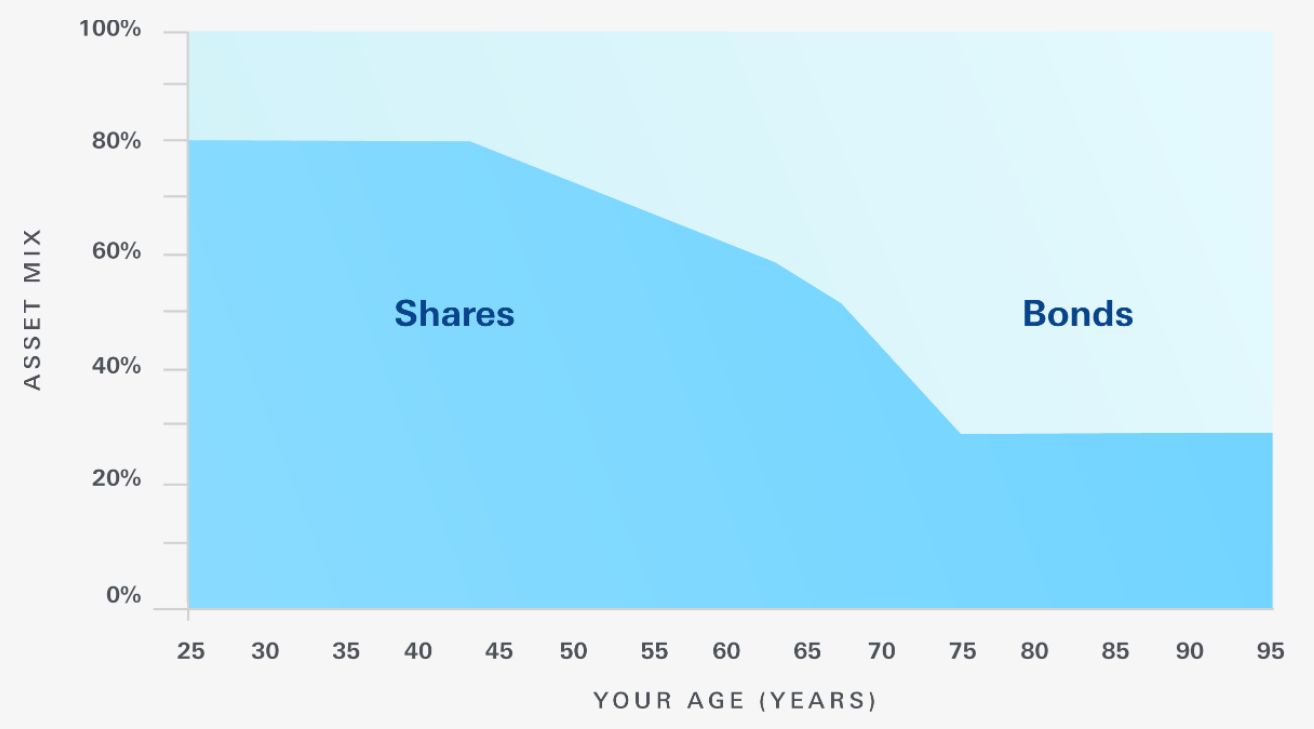

The common rule of thumb (not a strict rule) is for the percentage in bonds to equal your age. So as you get closer to retirement/withdrawal, you go for assets with lower risk. You can also have a look at the target retirement funds from Vanguard (pioneer of index funds), either for inspiration or as a super-easy passive way to invest if you’re in a country like the UK or the US but not France. These funds only provide exposure to stocks and bonds so no commodities nor crypto.

© Vanguard Asset Management

© Vanguard Asset Management

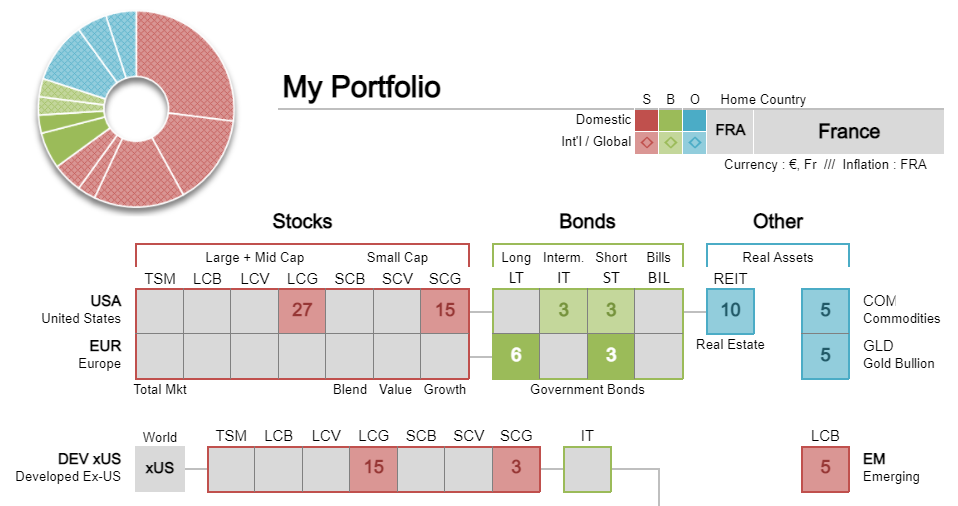

I found the 8 Lazy Portfolios to have good inspiration in deciding allocations. If you’re in the UK, there’s a UK-oriented view that might also be worth reading. I started with David Swensen’s Ivy League Portfolio and tweaked it to have the asset classes and allocation percentages below. As a seeker of growth and acknowledging the US as the centre of the world’s economy (at least for the foreseeable future), I’ve set the majority (~54%) of my stocks to be American companies.

| Asset Class | 2020 | 2021 |

|---|---|---|

| Stocks | 60% | 60% |

| - US | 27% | 27% |

| - Other developed countries | 13% | 18% |

| - Emerging countries | 5% | 5% |

| - Real estate & dividend | 15% | 10% |

| Bonds | 20% | 15% |

| Commodities | 10% | 10% |

| Crypto | 10% | 15% |

Within bonds and real estate & dividend stocks, I also diversify geographically. In early 2021, I made my allocations more growth aggressive by reducing bonds by 5% and increasing crypto by the same amount. This increase in crypto came also as I did more research and found many (40+) crypto coins/tokens that I would like exposure to. I reduced real estate & dividend stocks because they are not my priority right now and I have to pay 30% tax on all dividend (even if not withdrawn).

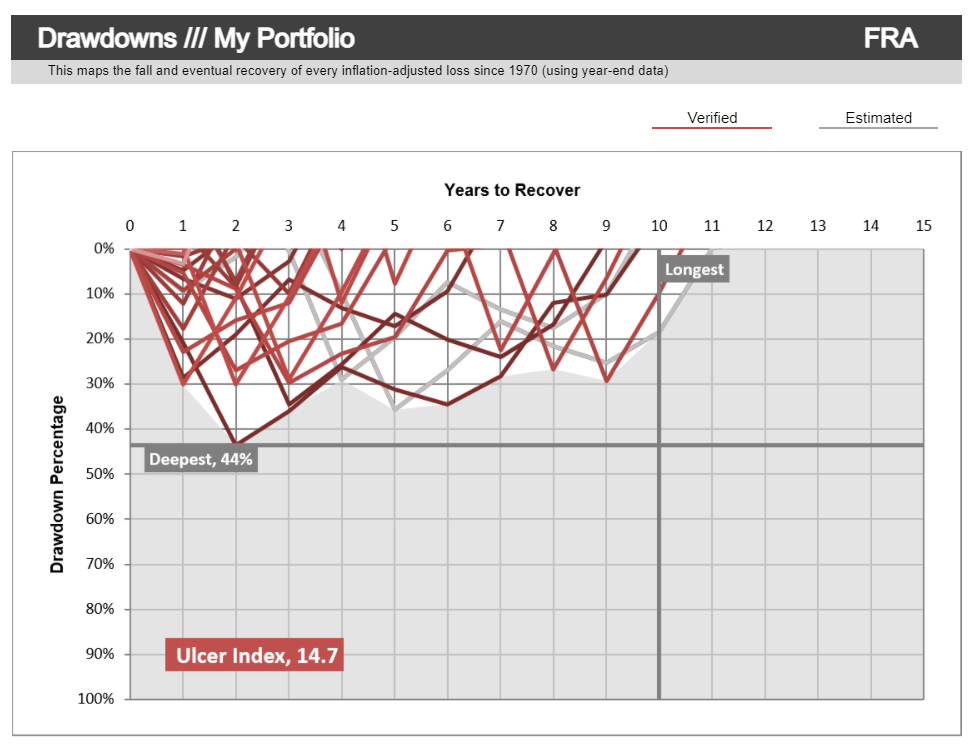

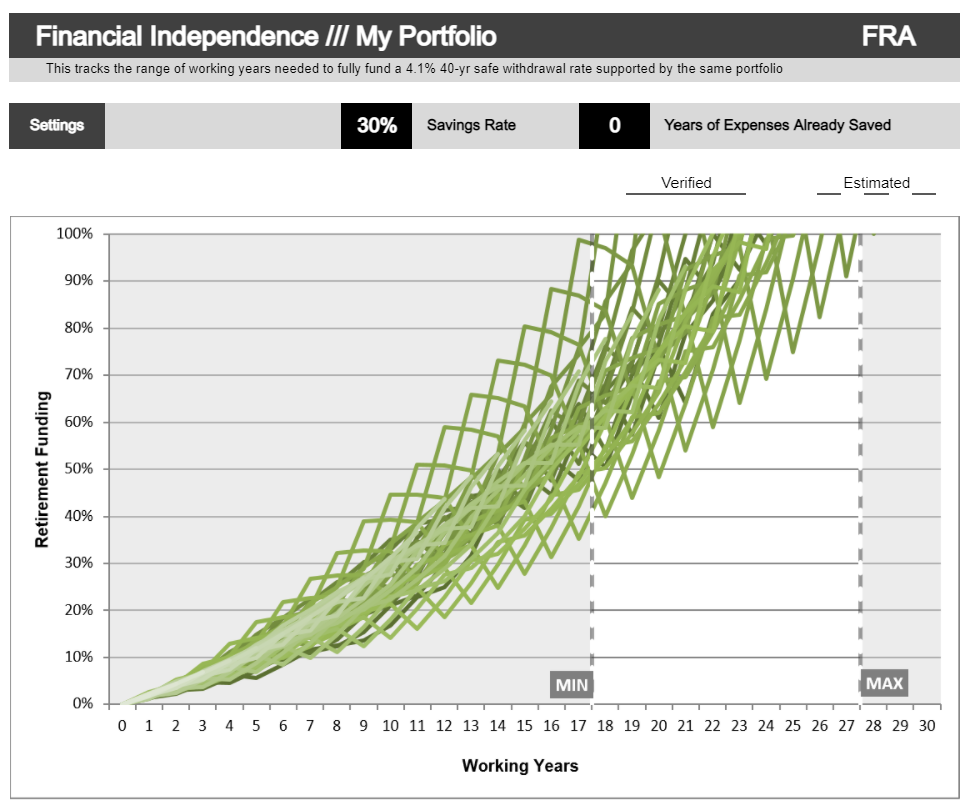

PortfolioCharts.com is a great site to compare well-known, professionally recommended portfolios and to see how your chosen portfolio would have done in the past decades. The site has many charts that easily visualise risk & volatility, the uncertainty of returns and even financial independence. I used the portfolio builder with the inputs below (my portfolio link) to analyse my target portfolio. I assume my 15% crypto to be American Small-Cap Growth (SCG) stocks (but crypto is more volatile and less correlated to the stock market). My 15% bonds (green) are split across different bond types which I will detail in a future article.

Drawdown is a measure of downside volatility, so concretely, how much of a drop in portfolio value I could see from a peak and for how long. The chart below shows the historical drawdowns that my built portfolio would have seen from 1970 to 2015. The deepest drawdown was a 44% drop and took 2 years to recover. The longest drawdown took 10 years to recover. This data takes into account inflation (France in this case), so a drawdown needs to return to the previous peak value but adjusted for inflation.

The many other charts include those allowing you to plan financial independence. The chart below shows that if I invest 30% of my income in this portfolio, I could retire in 18-28 years (aged 43-53). This assumes my current monthly expenses (the remaining 70%) will be enough for me then when adjusted for (French) inflation, but this won’t be enough if I will have more financial responsibilities like children. More details here and here on how the calculation is done.

Broker/Exchange

If I wanted to take the super-easy passive route to have stocks & bonds, I would go for a low-fee fund like one of Vanguard’s retirement funds. If I wanted to take the standard passive route of only index funds without any individual stocks, then I would go for a broker like Vanguard which has a wide range of low-fee funds. In the UK, Vanguard has a Stocks & Shares ISA to avoid getting taxed as well as a Junior ISA for parents to invest for their children.

If I wanted to take the mixed or active route (as I am), I would go for a more complete broker with the lowest costs and commission. In the US, there are many choices including M1 Finance and Robinhood. In most other countries including the UK and France, the best choice I’ve seen is Trading212 (if you sign up using my link we both get a free share).

With Trading212, depositing, withdrawing, buying and selling are all possible without fees nor commission. The only thing is the 0.15% currency conversion charge when you buy or sell something that’s not in your account’s currency. They largely make money from the CFD part of their platform which is for traders and not investors. In the UK, they provide a Stocks & Shares ISA (but no PEA in France). There’s also a practice part of every account should you wish to build up confidence in using the interface with fake money. As of May 2021, there’s currently a waitlist so if you choose Trading212 you might want to sign up ASAP.

I should also mention that if your workplace offers an investing account (e.g. Plan d’Épargne Entreprise (PEE) in France), then it can be good to do some investing in it. Normally, one big benefit is that you can invest from your salary before it gets taxed (unlike your received salary), and tax when withdrawing might be only on gains.

For crypto, hands down the biggest and best exchange is Binance (this referral link is not mine but you get 25% commission back with each trade). Binance has one of the lowest fees available, a very wide range of cryptocurrencies and insurance. Binance also has the highest liquidity which results in the market price to buy or sell a cryptocurrency tending to be the best in the global market at that point in time. There’s a separate Binance for the US. See also this complete beginner’s guide video.

7th: How much per month?

“Financial peace isn’t the acquisition of stuff. It’s learning to live on less than you make, so you can give money back and have money to invest. You can’t win until you do this.”

— Dave Ramsey

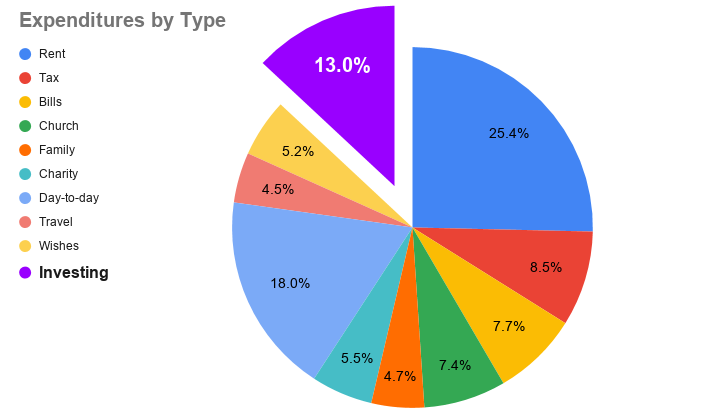

With asset class allocation defined and broker/exchange chosen, the next step was to figure out how much I can invest per month. I created a multi-currency budgeting spreadsheet (template on Google Sheets) based on cash flow forecasting to:

- view & plan my expenditures & income

- plan the building of my emergency fund

The first time I did this exercise I determined I could dedicate 13% of my expenditures (excluding saving for my emergency fund) to investing:

Minority Mindset recommends the percentages below for spending, investing and saving, depending on whether you have financial responsibilities (e.g. people that rely on you financially). Once (emergency fund) savings have reached an amount that could cover 6 months of your expenses, then you merge saving and investing into just investing. So for example, if you are investing 30% and saving 20% then you will switch to investing 50% of your income once your emergency fund has reached its maximum.

| Personal situation | Max spending | Investing | Saving |

|---|---|---|---|

| Young & no financial responsibilities | 50% | 30% | 20% |

| Financial responsibilities | 75% | 15% | 10% |

With the monthly amount figured out, ideally, I should just invest continuously every month without putting much thought into when prices will peak or bottom. This is Dollar-Cost Averaging (DCA). The more one removes emotion from investing and executes their plan robotically, the better they do long-term and reduce a lot of unneeded stress. If your broker or exchange offers automatic regular investing to a plan you create (as the case for Trading212’s pies), then it is a very good idea to do so.

Pay yourself first: The bank account I receive my salary is different to the one I use to spend. My spending bank account is on Revolut. When I receive my salary, I split it into investing, fixed monthly expenditures like bills and then figure out how much to budget for the coming month for my other expenses. This short but important monthly exercise helps me to save & invest straightaway as well as to fill my spending account with a set budget for the month.

Closing thoughts

I hope this article has given you plenty of ideas and tools for getting your personal finance in good order. I think financial literacy (or lack of it) is a big reason why the rich stay rich, the poor unfortunately stay poor and the gap between them widens. Investing in public markets is an accessible wealth-building process for anyone and not only a few elites.

Reminders: make a plan, avoid temporary hype (GME, DOGE) and never panic sell.

Leave a comment below with your thoughts. If you’ve found this insightful, share with a friend that needs to read this.

I have made a Telegram group where I will share updates to my portfolio and notify of new articles I publish. Upcoming articles:

- Commodities & Crypto

- Stocks & Bonds

Peer-reviewed by Thomas Akinola.